You've built something incredible. Your small business for sale in Tampa FL represents years of late nights, tough decisions, and breakthrough moments that most people will never experience.

But here's the unfiltered truth that most successful business owners aren't told until it's too late: The way you price your business for sale can make or break everything you've worked for.

I've watched too many Tampa business owners price themselves out of life-changing exits. Smart, hardworking entrepreneurs who did everything right: except this one crucial piece. And it cost them hundreds of thousands of dollars they'll never get back.

Don't let that be you.

The High-Stakes Reality: Why Pricing Mistakes Are Deal Killers

When qualified buyers evaluate businesses for sale Tampa Florida, they're not just looking at your numbers: they're stress-testing every assumption. One pricing red flag, and they're out.

Here's what happens when buyers encounter common pricing mistakes:

❌ They question your financial credibility

❌ They assume hidden problems exist

❌ They walk away without counteroffering

❌ They share concerns with other potential buyers

You're not just selling "a business." You're selling your time, your freedom, your next chapter. Get the pricing wrong, and qualified buyers disappear faster than snowbirds heading north in May.

Mistake #1: The "Sky-High Dreamer" Trap (Overpricing Your Business)

The Problem: You've priced your business based on emotion, not market reality.

I get it. Your business is your baby. You see the potential, the growth trajectory, the "what if we just had more time" scenarios. But qualified buyers? They see hard data and comparable sales.

What Scares Buyers Away:

- Asking prices 30-50% above market comps

- Justifying high valuations with "future potential"

- Pricing based on what you "need" for retirement

- Ignoring recent market corrections in your industry

✅ What Smart Sellers in Tampa Are Doing Instead:

Start with professional business valuation from an experienced business broker in Tampa who knows your industry. We analyze recent sales of comparable businesses, not just wishful thinking.

Quick Reality Check: If your asking price makes buyers' eyebrows go up instead of their offers coming in, you've already lost.

Mistake #2: Ignoring Add-Backs (And Confusing Your True EBITDA)

The Problem: You're not properly presenting your business's real earning potential.

This one trips up even savvy business owners. You might be running personal expenses through the business or paying yourself below market rate. But if you don't clearly document these "add-backs," buyers can't see your true profitability.

What Qualified Buyers Need to See:

- Owner's salary normalized to market rates

- Personal expenses removed from business costs

- One-time expenses clearly identified

- Family payroll adjusted to fair market value

Example: Your P&L shows $150K profit. But you pay yourself $40K when a manager would cost $80K. Plus $15K in personal expenses run through the business. Your real EBITDA? $225K: 50% higher than it appears.

Miss this presentation, and buyers assume what they see is what they get.

Mistake #3: The "One-Size-Fits-All" Pricing Strategy

The Problem: You're not considering special financing options or industry-specific buyer types.

Different buyers have different capabilities. SBA buyers can finance differently than cash buyers. Strategic acquirers value synergies differently than financial buyers.

❌ The Dangerous Path Many Business Owners Take:

- Setting one firm price for all buyer types

- Ignoring SBA financing advantages

- Not understanding strategic vs. financial buyer motivations

- Failing to structure deals for optimal buyer qualification

✅ Here's What Experienced Business Brokers Tampa FL Do:

We structure pricing and terms to attract your best-fit buyer. Cash deal? Strategic acquisition? SBA financing? Each path has optimal pricing strategies that maximize your outcome.

Mistake #4: Inventory and FF&E Confusion (The "Hidden Costs" Problem)

The Problem: Your pricing doesn't clearly address inventory, fixtures, furniture, and equipment.

Nothing kills buyer enthusiasm faster than surprise costs. If your asking price seems to include everything but suddenly they need $50K more for inventory, you've created a trust problem.

What Smart Sellers Do:

- Clearly separate business goodwill from assets

- Provide detailed inventory and FF&E valuations

- Offer multiple purchase structures (asset vs. stock sale)

- Present transparent, itemized pricing breakdowns

Pro Tip: In Florida, many business sales work best as asset purchases for tax advantages. Make sure your pricing reflects this reality.

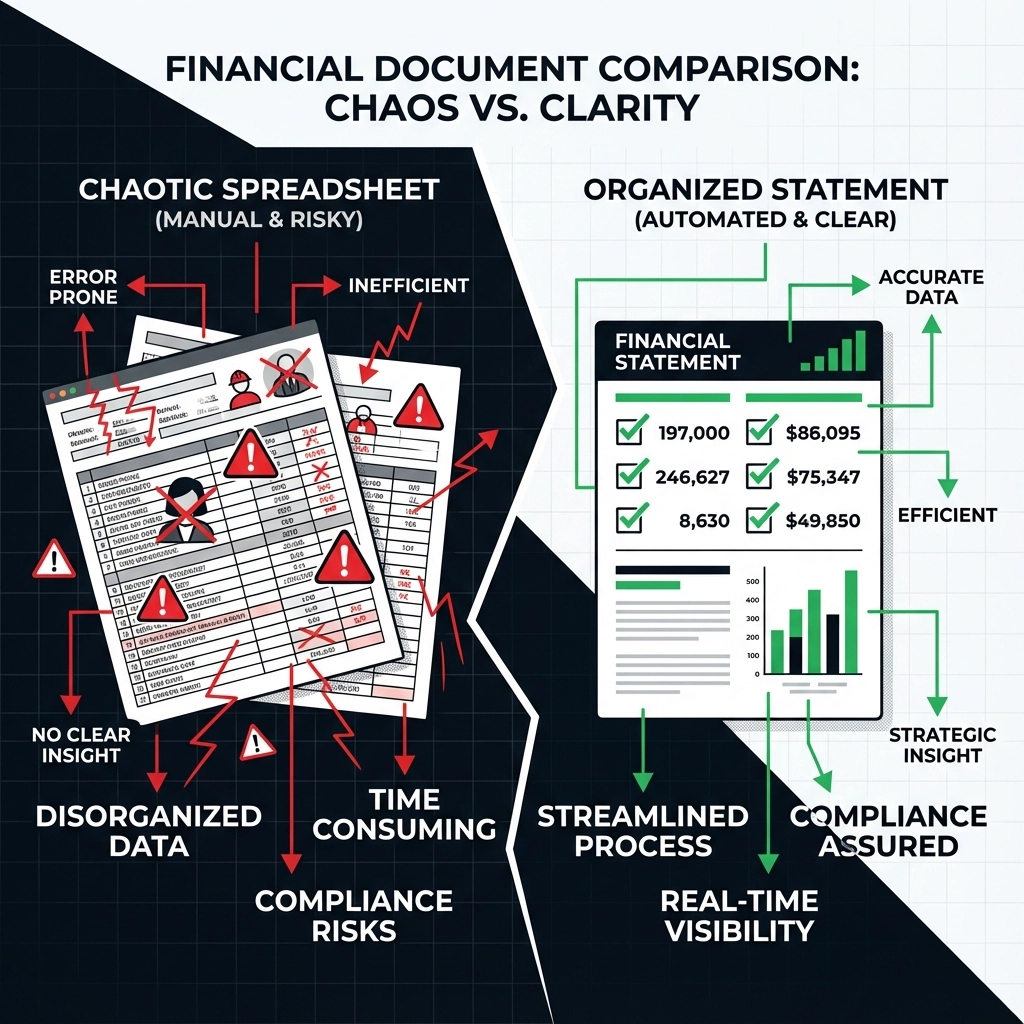

Mistake #5: Poor Financial Presentation (Making Buyers Work Too Hard)

The Problem: Your financials require a forensic accountant to understand.

Qualified buyers want to see clean, clear, professionally presented financials. If they have to dig through messy books or make assumptions about your numbers, they'll assume the worst and move on.

Red Flags That Scare Away Qualified Buyers:

- Inconsistent record-keeping across years

- Cash transactions that aren't properly documented

- Revenue streams that can't be verified

- Expenses that seem personal but aren't clearly marked

✅ What Gets Buyers Excited:

Three years of clean financials, preferably reviewed by a CPA, with clear explanations of any unusual items. When buyers can quickly understand your profitability, they focus on making offers instead of finding problems.

The Tampa Bay Advantage: Why Local Market Knowledge Matters

Selling a business for sale in Clearwater FL or anywhere in Tampa Bay requires understanding our unique market dynamics:

- Seasonal buyer patterns (snowbirds, winter relocation)

- Industry clusters (marine, hospitality, healthcare, tech)

- SBA lending relationships with local banks

- Strategic buyer networks across Florida

A business broker in Tampa Florida with local connections moves your deal faster and gets better prices than generic online listings or out-of-state brokers.

Quick Action Steps: Price Your Business Like a Pro

Before You List, Do This:

- Get a Professional Valuation - Not a free online calculator

- Clean Up Your Financials - Three years, CPA-reviewed preferred

- Document All Add-Backs - Make your true EBITDA crystal clear

- Research Recent Comps - What sold, not what's listed

- Structure Multiple Offers - Different buyers, different optimal terms

Don't Wing This: The difference between amateur pricing and professional pricing isn't just thousands of dollars: it's often the difference between selling and not selling at all.

Your Next Step: Let's Talk Strategy Before You List

You've worked too hard and come too far to leave money on the table because of pricing mistakes.

Here's what happens in our confidential 15-minute consultation:

- We'll review your business category and current market conditions

- I'll share recent comparable sales data for your industry

- You'll get straight-talk pricing guidance based on real buyer feedback

- We'll discuss timing strategies for maximum value

No pressure. No long sales pitch. Just professional insights from a licensed business broker who's helped dozens of Tampa Bay business owners achieve life-changing exits.

Ready to price your business for success? Let's have that conversation.

Book your confidential consultation: Schedule 15 minutes here

Call/Text: Direct line for immediate questions

Email: Quick questions answered within 24 hours

Lobo Business Sales LLC is a licensed business brokerage serving Tampa, Wesley Chapel, Clearwater, St. Petersburg, and throughout Florida. We specialize in confidential business sales, strategic exit planning, and maximizing value for business owners ready for their next chapter.

#TampaBusinessBroker #FloridaBusinessSales #TampaBayBusiness #BusinessForSale #FlBusiness #TampaEntrepreneur #BusinessExit #SellMyBusiness

Leave a Comment